Insights

How to Apply for Early Super Access - COVID-19

Along with a number of Government and state based initiatives designed to help businesses and individuals cope with financial hardship due to COVID-19, individuals may be eligible to access up to $20,000 of superannuation funds early.

Implications on retirement

Before applying to access super under the stimulus initiative, it is important to check eligibility criteria and to understand the impact on retirement savings both short and long-term and other implications on individual circumstance.

Read our article on ‘Proceeding with caution’ here and ‘How to rebuild retirement savings’ here.

Who is eligible?

Applicants must satisfy one or more of the following:

- You are unemployed.

- You are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance.

- On or after 1 January 2020, either

- you were made redundant

- your working hours were reduced by 20% or more

- if you were a sole trader, your business was suspended or there was a reduction in turnover of 20% or more.

How to apply

Applications must be lodged via the ATO MyGov website before 30 June 2020 to access an amount of up to $10,000.

A second application of $10,000 may be applied for between 1 July and 24 September 2020.

Step 1

Log in to your MyGov account through https://my.gov.au/. If you don’t have an account, create a MyGov Account portal here. To link the ATO to your MyGov account, click here.

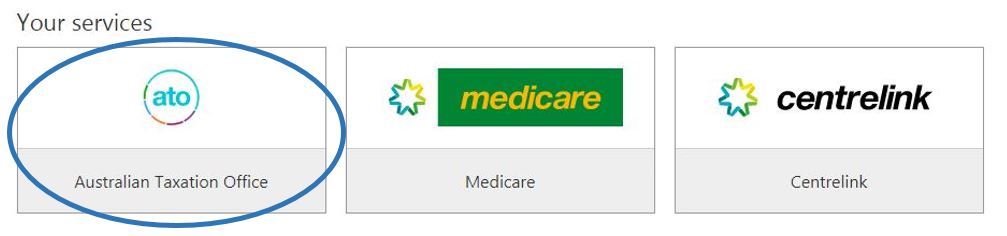

Step 2

Select the ATO service.

Step 3

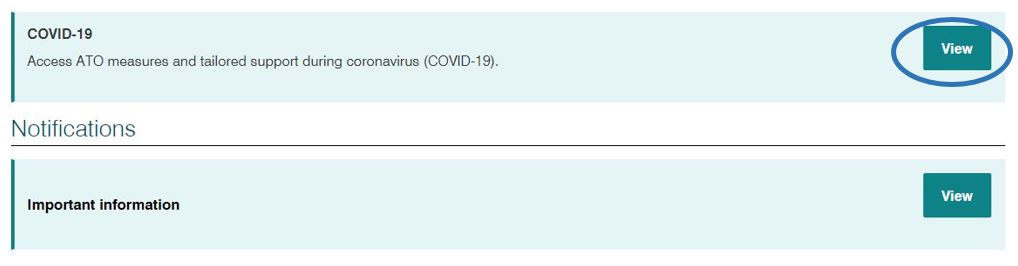

Click the ‘view’ button to the right of the COVID-19 section.

Step 4

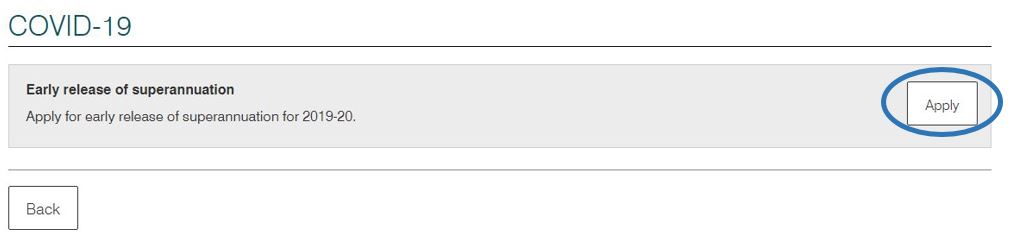

Click the ‘apply’ button on the right of the ‘early release of super’ section.

Step 5

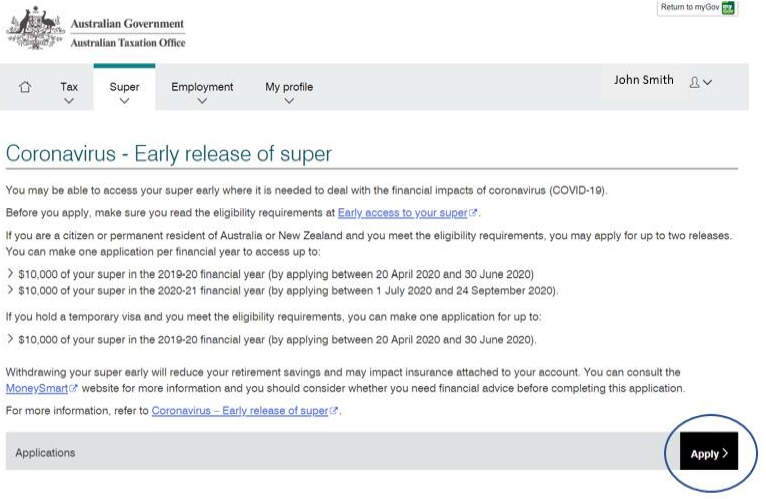

Read the important information on the Coronavirus – Early release of super page before clicking ‘apply’.

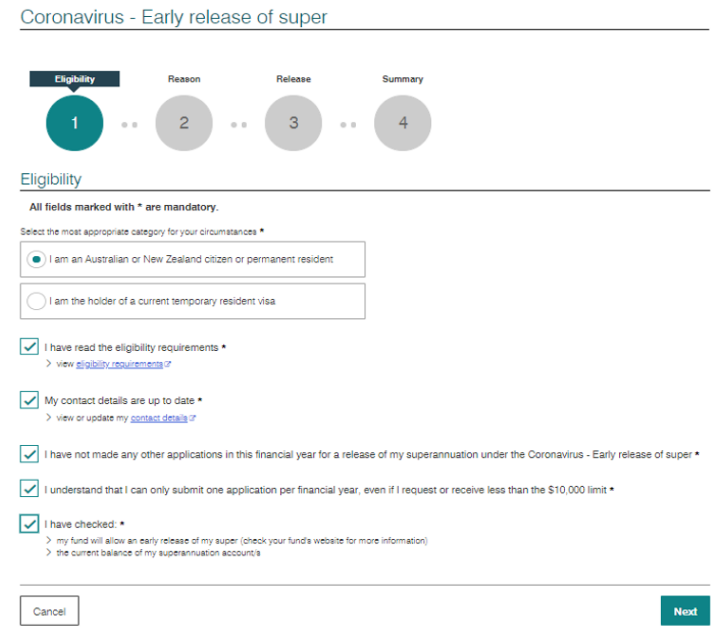

Step 6

Check each box after confirming eligibility details and reading the relevant information before clicking ‘next’.

IMPORTANT: Once an application is submitted it cannot be changed. Only one application per financial year is accepted, even if the amount elected is less than the maximum of $10,000.

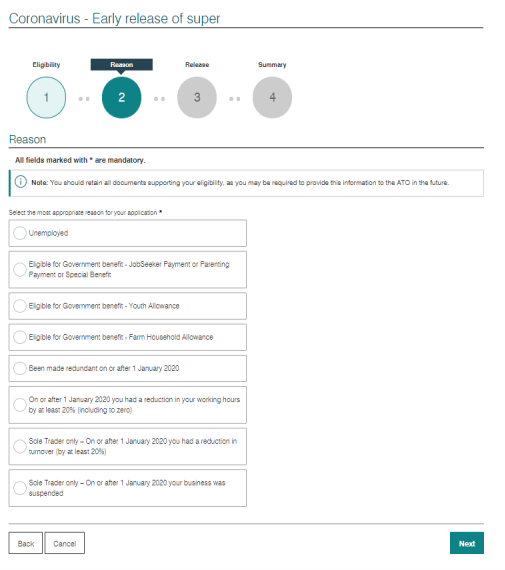

Step 7

Select the reason for applying from the provided options and click ‘next’. Evidence to support the application is not required however may be requested by the ATO in the future.

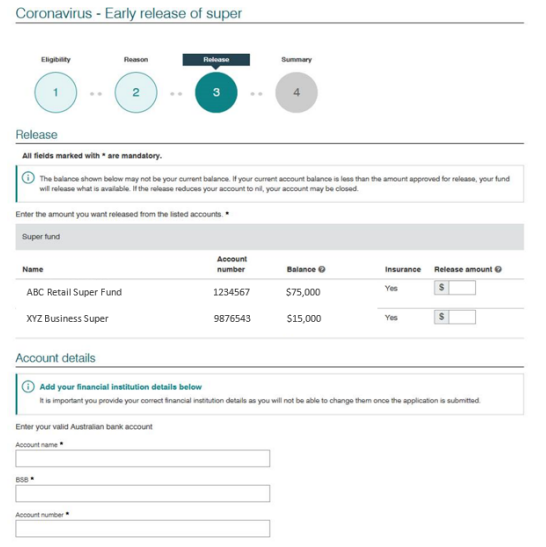

Step 8

All accumulation accounts the ATO has on record for you will be displayed. However balances may not reflect current account balances. If the balance is not sufficient, please check with your fund.

Money may be chosen to be withdrawn from multiple accounts provided the total is no more than $10,000.

Account details are required for the account where the funds are to be deposited.

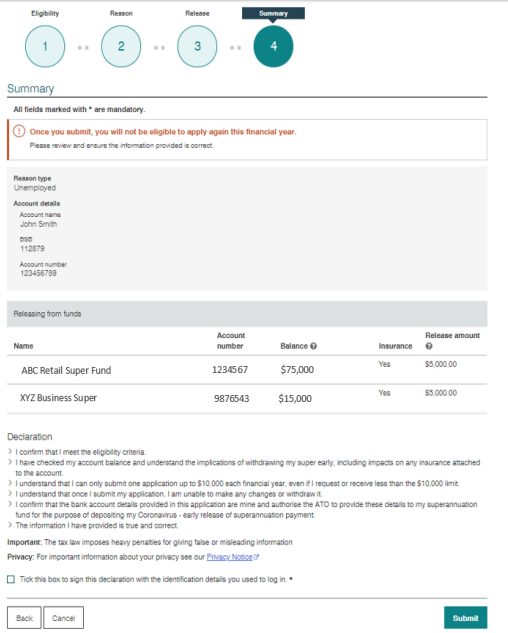

Step 9

Check all information displayed on the summary screen is correct. Read the important Declaration information before clicking ‘submit’.

What happens next?

The ATO will assess the application and determine if you are eligible for a release. The ATO will then send that determination to you and the nominated super fund/s. This process is expected to take a few days. The super fund will then process the release to you.

Below are some articles that may interest you:

The right investment strategy is one that moves you toward your lifestyle potential without losing sleep at night. Let a Modoras Financial Planner guide you to a strategy that will meet your goals. Call us on 1300 888 803 for a complimentary consultation.

IMPORTANT INFORMATION: This blog has been prepared by Modoras Pty. Ltd. ABN 86 068 034 908 an Australian Financial Services and Credit Licences (Number 233209). The information and opinions contained in this presentation is general information only and is not intended to represent specific personal advice (Accounting, taxation, financial, insurance or credit). No individuals’ personal circumstances have been taken into consideration for the preparation of this material. Any individual making any investment or borrowing decisions should make their own assessment taking into account their own particular circumstances. The information and opinions herein do not constitute any recommendation to borrow funds or purchase, sell or hold any particular investment. Modoras Pty Ltd recommends that no financial product or financial service be acquired or disposed of, credit contract entered into or financial strategy adopted without you first obtaining professional personal financial advice suitable and appropriate to your own personal needs, objectives, goals and circumstances. Information, forecasts and opinions contained in this blog may change without notice. Modoras Pty. Ltd. does not guarantee the accuracy of the information at any particular time. Although care has been exercised in compiling the information contained within, Modoras Pty. Ltd. does not warrant that the articles within are free from errors, inaccuracies or omissions. To the extent permissible by law, neither Modoras Pty. Ltd. nor its employees, representatives or agents (including associated and affiliated companies) accept liability for loss or damages incurred as a result of a person acting in reliance of this publication.