Insights

Accessing Super Early: What your future self would tell you

Following the announcement that part of the stimulus package allows eligible individuals to access up to $20,000 of their super tax-free, the ATO has approved over 456,000 applications.

BDO superannuation partner Mark Wilkinson is urging Aussies not to rush the decision, explaining that implications in 30-40 years’ time could be life-changing.

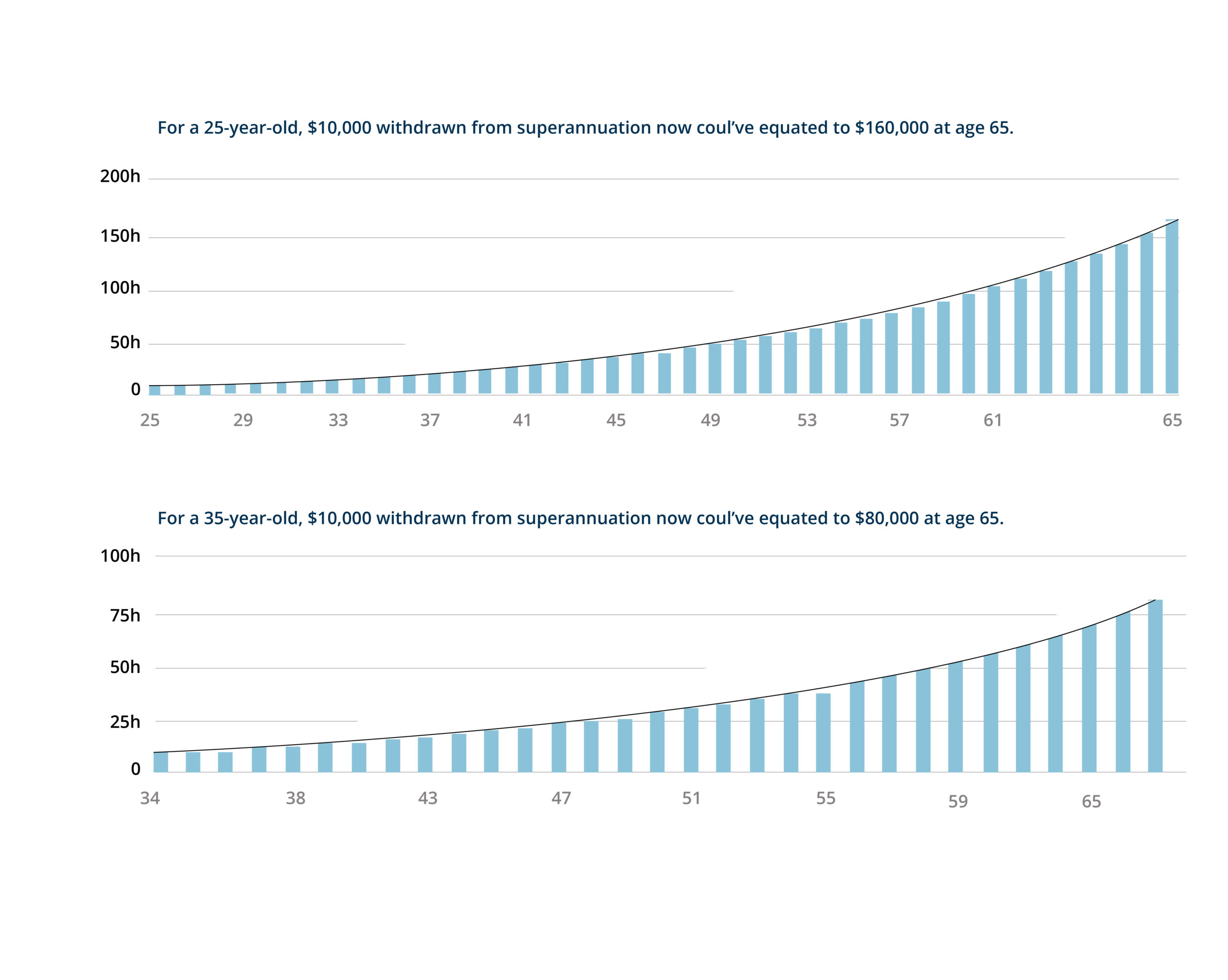

While accessing super during a time of financial hardship can ease pressure, $10,000 today could mean $160,000 when it comes to retirement in 40 years’ time.

How will this affect retirement?

Many factors play a part in how this will affect super funds later in life, such as the age of withdrawal, how much is withdrawn and when retirement will be.

The following questions are a few of the variables which contribute to long term effects:

- What will the money withdrawn be used for?

- How long until retirement?

- Will catch-up contributions be made?

- What investment return will be earnt in the future?

- What fees and taxes will be paid on remaining retirement money?

The following graphs highlight the ability of this variation to affect funds at retirement when withdrawing of funds occurs at 25 and 35:

It is also important to note that if $20,000 (the full amount, two lots of $10,000 withdrawn at separate times, see our article here for more information on rules of withdrawal), it is not possible to return all withdrawn funds at one time as contribution caps exist.

The end net result is highly dependent on investment assumptions, made up of:

- The average return rate on investments

- Tax rates

- Average inflation rate

- Likely average fees

What is the difference between nominal and real returns?

Nominal returns are what an investment is expected to produce, without inflation taken into account.

Real returns take into account inflation.

To example the difference between the two, if the S&P/ASX200 average return of 7.9% is taken and assumed inflation over the period was 3%, then the real return is 4.9%

The main difference here making predictions based on nominal or real returns is are they predicted using future dollars or today’s dollars.

The 72 rule

A simple formula for calculation is the 72 rule.

To calculate how long it will take for money to double in value based on average return, divide the rate of return by 72.

As an example, if a 7% return is assumed, it will take approximately 10 years for money to double in value.

Below are some articles that may interest you:

With a financial advisor, taking steps to secure your futures nest egg can be an easier process. Let a Modoras Financial Planner guide you to a strategy that will meet your goals. Call us on 1300 888 803 for a complimentary consultation.

IMPORTANT INFORMATION: This blog has been prepared by Modoras Pty. Ltd. ABN 86 068 034 908 an Australian Financial Services and Credit Licences (Number 233209). The information and opinions contained in this presentation is general information only and is not intended to represent specific personal advice (Accounting, taxation, financial, insurance or credit). No individuals’ personal circumstances have been taken into consideration for the preparation of this material. Any individual making any investment or borrowing decisions should make their own assessment taking into account their own particular circumstances. The information and opinions herein do not constitute any recommendation to borrow funds or purchase, sell or hold any particular investment. Modoras Pty Ltd recommends that no financial product or financial service be acquired or disposed of, credit contract entered into or financial strategy adopted without you first obtaining professional personal financial advice suitable and appropriate to your own personal needs, objectives, goals and circumstances. Information, forecasts and opinions contained in this blog may change without notice. Modoras Pty. Ltd. does not guarantee the accuracy of the information at any particular time. Although care has been exercised in compiling the information contained within, Modoras Pty. Ltd. does not warrant that the articles within are free from errors, inaccuracies or omissions. To the extent permissible by law, neither Modoras Pty. Ltd. nor its employees, representatives or agents (including associated and affiliated companies) accept liability for loss or damages incurred as a result of a person acting in reliance of this publication.