Insights

Why Women Are Better at Investing – And Why They’re Not

It’s just a matter of perspective.

To be successful in something, like investing, many may think an overhaul of one’s values or ethics is needed. But this is far from the case, all it takes is to embrace one’s inherent qualities and make them work to one’s advantage—just like the proverbial lemonade.

Successful investing for women

Women may look like they got the short end of the stick when it comes to investing. However, this should not be the case. According to statistics, fewer women are investing than men*. But it’s not for reasons one may think.

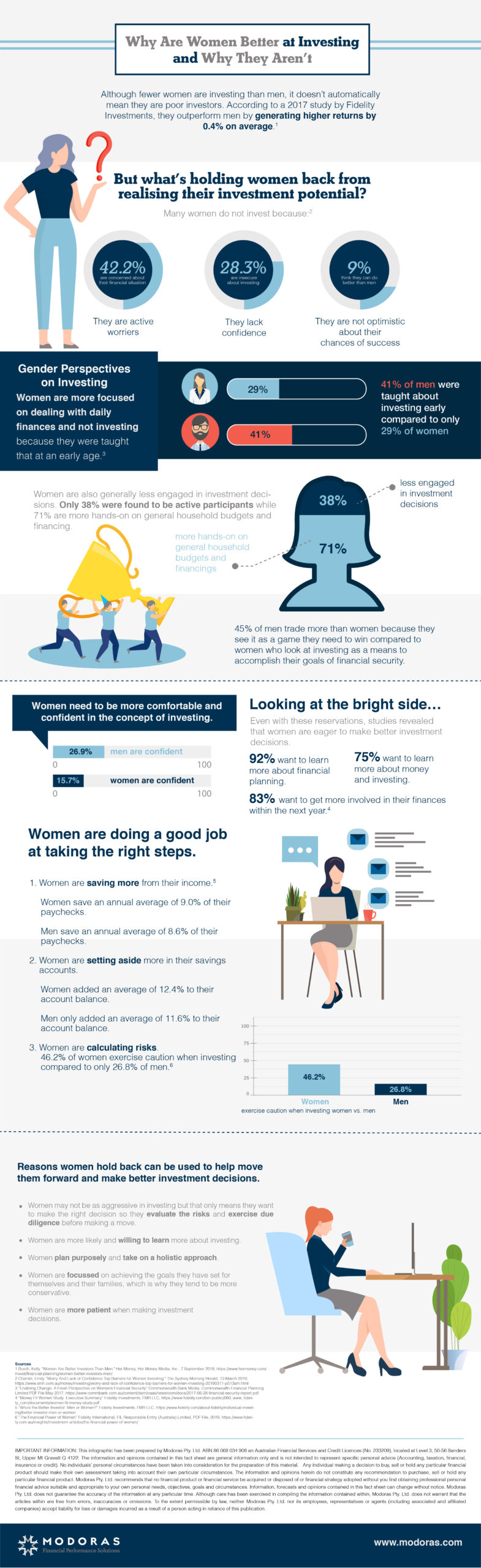

No, it’s not because women are poor investors. In fact, they are often better at it. According to a 2021 study by Fidelity Investments, women have more successful portfolios, generating positive returns by 40 basis points, or 0.4% on average, an analysis of annual performance across 5.2 million accounts from January 2011 to December 2020 show.

Considering not many women are optimistic about their chances of investment success (only 9% think they can do better than their male counterparts), the results are significant in dissecting the underlying reasons for women’s perceived lack of financial prowess.

The key word here is “perceived” as it’s all in the mind.

Women and their financial mindset

There’s a reason why we always hear “mind over matter” and other similar phrases. The mind is a powerful tool and it is substantial in uncovering the mysteries behind women’s financial power.

There are several barriers to women’s financial success. In The Financial Power of Women study, Financial International found that women are active worriers and often lack the confidence to invest. Women may be unconsciously hurting their chances for success by imbibing a negative financial outlook.

Even though 42.2% expressed concern about their financial situation, few of them take action. They either think of investing as too complicated or that a lot of money is required. The lack of confidence in 28.3% of women, puts them at even more of a disadvantage because they approach retirement age without a clear idea of how much they need to afford their retirement lifestyle.

Getting past this mental hurdle can be tremendously helpful for a woman’s financial well-being.

Women have more successful portfolios, generating higher returns by 0.4% on average.

Investing for men versus investing for women

It’s worth taking a look at the inner workings of the psyche of both sexes to understand what influences these discrepancies.

Female vs Male: Perspective on Investing

Conservative thinking could be partly to blame. And so are women’s inherent traits.

Men are more likely to invest because they look at it in a slightly different manner than women. 45% of men trade more than women because they see it as a game—a competition to be *on—compared to women who see investing as a means to accomplish their goals of financial security.**

In this perspective, women have more to lose. And that’s why they are risk-averse, which is also reflected in the Financial International survey. They “prefer the perceived safety of cash” and have their sights more focused on saving or paying off debts, which makes sense especially because more women are taught to manage daily finances, over investing (26% said that they are more likely to pay off a loan instead of investing if they get extra cash).***

Gender Roles and Education

Data from a May 2017 report called A Fresh Perspective on Women’s Financial Security backs this claim: women have a varied perspective on financial security because, compared to men, 53% of women were taught to focus on dealing with everyday finances and not investing at an early age. On the other hand, 41% of men were taught about investing early on compared to just 29% of women.

Not to mention that women are generally less engaged in investment decisions. Only 38% were found to be active participants in investing while 71% of them are more hands-on on general household budgets and financing.

It is also quite possible that this could have stemmed from the norms surrounding women’s roles. Women have been found to have less in retirement savings, than men because of the existing gender gaps in terms of superannuation and pay. The reasons can be traced back to the fact that women make less money than men.

Furthermore, women live longer than men. Those additional years rack up additional expenses which can erode one’s retirement savings quicker.

Women take career breaks to raise children, which translates to them spending less time in the workforce where they could be accumulating super. They are also likely to work part-time jobs and get lesser pay. Both situations mean female workers will have reduced super contributions. And if we factor in concessional taxes, there’s a big chance that how much women are going to get at retirement age will be significantly lesser than men.

Women and Risk Aversion

Interestingly, it’s the same traits that could help women become more successful at investing. Their aversion—which should be looked more as awareness—to risk could potentially help them avoid making investment errors—and lose a significant amount of money. 46.2% of women are very cautious when it comes to investing, compared to only 26.8% of men. What does this mean?

It could imply that unlike men, who view investing more as a game to be won, women are more likely to perform due diligence to ensure that all investment decisions they make are well-informed. Despite the low confidence levels (15.7%) compared to men (26.9%), women do not lose sight of their goals when investing, which serves as a strong enough motivation.

And since many women are insecure about their investment knowledge, they are likely to want to learn more about investing. They plan purposely and take on a holistic approach. As mentioned earlier, women are more focused on achieving the goals they’ve set for themselves and their families, and that is exactly why they tend to be more conservative about their investments, and not make impulsive decisions especially during market fluctuations.

They are also seen to exercise more patience than men, who are 35% more likely to make trades. The ability to hold em not fold em, may prove fruitful in the long run.

So what can we do to lessen the gender gap and help women realise their investing potential?

Frankly speaking, a lot needs to be done to address the key causes of these gender gaps and inequalities in the system. Policy development will also play a crucial role and it would require the help of not just one party.

However, there are elements that are well within our control, like our mindset.

Investing for success doesn’t completely rely on strategies or even gender, for that matter. The reason men and women perform differently is they have different perspectives.

And if we adopt a more conducive outlook towards investments, not only could we help close these gaps but we could also stop looking at investment as a man versus woman debate and start treating it as a means to help everyone fully realise their lifestyle potential.

What about you? Do you want to make better investing decisions?

Discover what more is possible for your future by getting help from a Modoras Planner. Call us today on 1300 888 803 or book an appointment by clicking here.

Sources:

*“2021 Women and Investing Study” Fidelity Investments, FMR LLC;

IMPORTANT INFORMATION: This blog has been prepared by Modoras Pty. Ltd. ABN 86 068 034 908 an Australian Financial Services and Credit Licences (Number 233209). The information and opinions contained in this presentation is general information only and is not intended to represent specific personal advice (Accounting, taxation, financial, insurance or credit). No individuals’ personal circumstances have been taken into consideration for the preparation of this material. Any individual making any investment or borrowing decisions should make their own assessment taking into account their own particular circumstances. The information and opinions herein do not constitute any recommendation to borrow funds or purchase, sell or hold any particular investment. Modoras Pty Ltd recommends that no financial product or financial service be acquired or disposed of, credit contract entered into or financial strategy adopted without you first obtaining professional personal financial advice suitable and appropriate to your own personal needs, objectives, goals and circumstances. Information, forecasts and opinions contained in this blog may change without notice. Modoras Pty. Ltd. does not guarantee the accuracy of the information at any particular time. Although care has been exercised in compiling the information contained within, Modoras Pty. Ltd. does not warrant that the articles within are free from errors, inaccuracies or omissions. To the extent permissible by law, neither Modoras Pty. Ltd. nor its employees, representatives or agents (including associated and affiliated companies) accept liability for loss or damages