Share Market News: COVID-19 Update 3

Before we get into some market insights, we’d like to address what is most important – to those who have been impacted by COVID-19, whether it be for health reasons, financial reasons or both, our thoughts and best wishes are with you at this time. Please know that where we can, we will help and are just a phone call away.

As the world experiences the impact of this global pandemic, we have seen unparalleled levels of uncertainty, extreme market volatility and widespread business disruption. This has led to a significant level of global Government spending in an attempt to prop up their local economies. A health crisis has quickly become a financial crisis, where no one is immune to its impact.

Despite the continued stimulus from Federal and State Governments to keep Australians employed and businesses in business, it is clear that a recession is inevitable. As can be seen from the queues outside Centrelink, not every business can operate under current restrictions, and not everyone can work from home during this lockdown period.

The impact on our clients has seen two vast spectrums. From clients who have lost their jobs and business owners who have taken pay cuts of between 20% and 50%, to keep business operational and layoffs to a minimum; to business owners and retirees who are positioned well during these challenging times. No matter how you look at it, this event marks a time in history that generations to come will learn about.

What is the potential impact on tax rates?

Governments globally have poured money into supporting their people and businesses. The ‘JobKeeper’ package bought the Australian Governments total support to $320 billion, or 16.4% of Gross Domestic Product (GDP). And the Government has announced that there is more to come. Other than the significant investment to support our people, the challenge ahead is that there will be less tax revenue as unemployment rises.

So this begs the question, who is going to pay for all this? Tax rates have been a hot topic for some time, with many believing that the GST is too low. Even before this pandemic hit. So will the Treasurer announce a rise in the GST? Or will income and corporate tax rates and the Medicare levy be on the list? Or perhaps all of the above will be considered. This will be a political matter, as much as a financial one. And one that will likely be addressed over the next 12 months as recovery starts to take place.

What does this mean for markets?

As toilet paper slowly returns to the shelves, fear and panic buying is subsiding. One could say there is a display of a little more rational decision making. We have observed similar behaviour with equity markets over the last two weeks. As we are no longer seeing the swings of 6-8% a day, not to say the rational behaviour will continue (if you can call 2-3% swings per day rational), or that the volatility seen just a short time ago, has stopped.

Whilst economist look in their rearview mirror to make the forecasts you hear in the news (use of historical economic data to predict future forecasts. Take employment figures for example, they are based on what happened last quarter), markets look forward to seeing what might be coming next. And the next 6 to 12 months poses some interesting questions:

- How many widgets do we expect Company ABC to sell next quarter and the next 12 months?

- And will this company still be as profitable moving forward?

In the current environment, we observe that the extremes are not isolated to our clients. From Flight Centre to Woolworths and Bunnings, these extremes have impacted even the biggest of businesses.

To give you real client examples:

John* and Mary* had booked a trip of a lifetime to Italy and France, leaving in May for 6 weeks. As the pandemic hits, a travel ban is laid down and the trip is cancelled. Booked through Flight Centre, John and Mary have experienced significant delays in the processing of their refund. Flight Centre have been inundated with similar requests and higher levels of staff turnover. Having now received a refund on their accommodation, the flights have been ‘credited’ for 12 months. Questions still remain:

- Will they still go within a year’s time?

- Will the same attractions they were going to see still be available and open to visit?

- Once the lockdown is over, will people start travelling the world again at the same rate as before the lockdown?

- How will this impact Flight Centre as a business?

And what about Woolworths?

We went to Woolworths on a Monday night a few weeks ago, on the way home from work. Jill* works in our local Woolworths store (you get to know the regular employees when you go to the same store for many years). She looked frazzled, so we asked her how she was going. She said that the last two days had been crazy. The staff couldn’t keep up with the demand, and on the Sunday, our small store turned over in excess of $1m. As toilet rolls start to fill the shelves again, baking ingredients are the next items disappearing, as children are on school holidays and require some entertainment.

And in the case of Bunnings – more people are staying home with more time on their hands. The home renovators are regularly hitting the home improvement store and spending more than they used to.

In short, whilst some companies struggle, others are doing well. No matter where the company sits on the spectrum, companies have to think innovatively and adjust their business model, to be sustainable in both the current and future state of play.

Where to next and what should we be considering?

Those who were fearful of what is to come, have now sold and left the market. This doesn’t mean equity markets won’t fall or that volatility won’t return, but a little more stability can be seen in comparison to last month.

As nations come to grips with the new world that we live in, and the impacts this is having on the social, business and financial landscape, people now have no choice but to comply with Government requirements of forced curbed behaviour.

Some interesting questions that we know we are all grappling with:

- Will there be less hand-shaking?

- Will the workforce maintain working from home, reducing the need for commercial office space?

- Will people resume travelling and if so, how long will it take for their confidence to return?

- What will business look like once restrictions have been lifted?

- How quickly can companies restart their business as the recovery begins?

- Will companies still be profitable?

- Is now a better time to enter the investment market than 3 months, 6 months, 1 year or even 3 years ago?

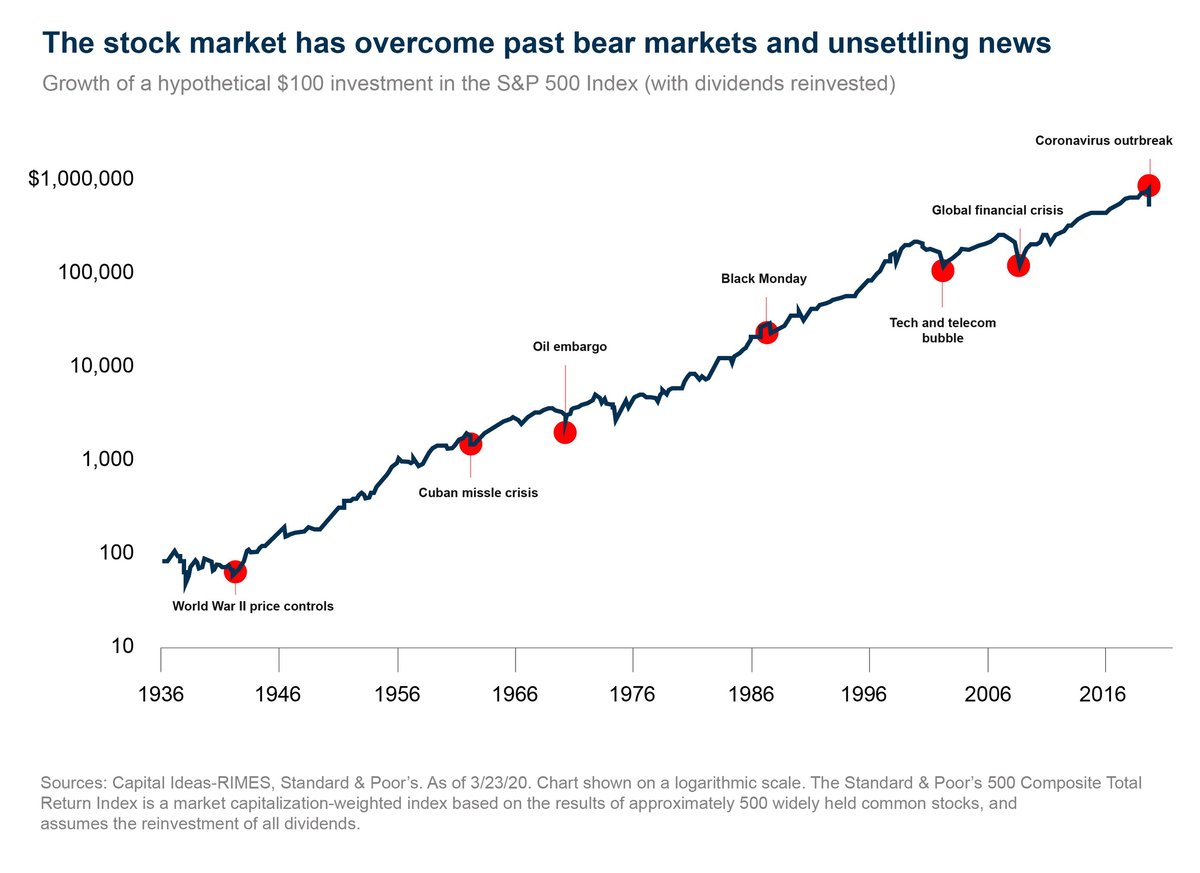

Given the considerations above? If your answer the last question is yes, then remember to remain focused on the long-term objectives, as often short-term volatility provides good opportunities for future wealth growth, as we can see in the graph below:

In conclusion, equity markets will return to some sense of stability only to experience the ebbs and flows as they always have. Now more than any other time in recent history, it is good quality advice that is of the utmost importance, helping navigate the complex economic landscape we are experiencing as of late.

*Not their real names

Modoras remain committed for your financial confidence, if you have questions or are not sure what action to take during times of market volatility, please contact us on 1300888803.

IMPORTANT INFORMATION: This blog has been prepared by Modoras Pty. Ltd. ABN 86 068 034 908 an Australian Financial Services and Credit Licences (Number 233209). The information and opinions contained in this presentation is general information only and is not intended to represent specific personal advice (Accounting, taxation, financial, insurance or credit). No individuals’ personal circumstances have been taken into consideration for the preparation of this material. Any individual making any investment or borrowing decisions should make their own assessment taking into account their own particular circumstances. The information and opinions herein do not constitute any recommendation to borrow funds or purchase, sell or hold any particular investment. Modoras Pty Ltd recommends that no financial product or financial service be acquired or disposed of, credit contract entered into or financial strategy adopted without you first obtaining professional personal financial advice suitable and appropriate to your own personal needs, objectives, goals and circumstances. Information, forecasts and opinions contained in this blog may change without notice. Modoras Pty. Ltd. does not guarantee the accuracy of the information at any particular time. Although care has been exercised in compiling the information contained within, Modoras Pty. Ltd. does not warrant that the articles within are free from errors, inaccuracies or omissions. To the extent permissible by law, neither Modoras Pty. Ltd. nor its employees, representatives or agents (including associated and affiliated companies) accept liability for loss or damages incurred as a result of a person acting in reliance of this publication.