Insights

Focusing on Retirement in the Current Environment

5 top tips for retirement investors in the current environment

While the COVID-19 pandemic has gripped the world, its impact on the economic, social and business environment has issued its first serious challenge for the new generation of investors in retirement as they embark on drawing down funds to support their lifestyle.

Making investment decisions that don’t match individual circumstances and goals in the current economic climate may lead to less financial freedom and reduced lifestyle opportunities moving forward.

Staying focused on long term goals can be challenging during times like this. However, maintaining a long-term lens, may help navigate the current complications without substantial long-term damage.

While each individual’s needs, income source and amount required to support their retirement lifestyle is different, there are 5 basic tips to help maintain focus:

1. Keep a long term perspective

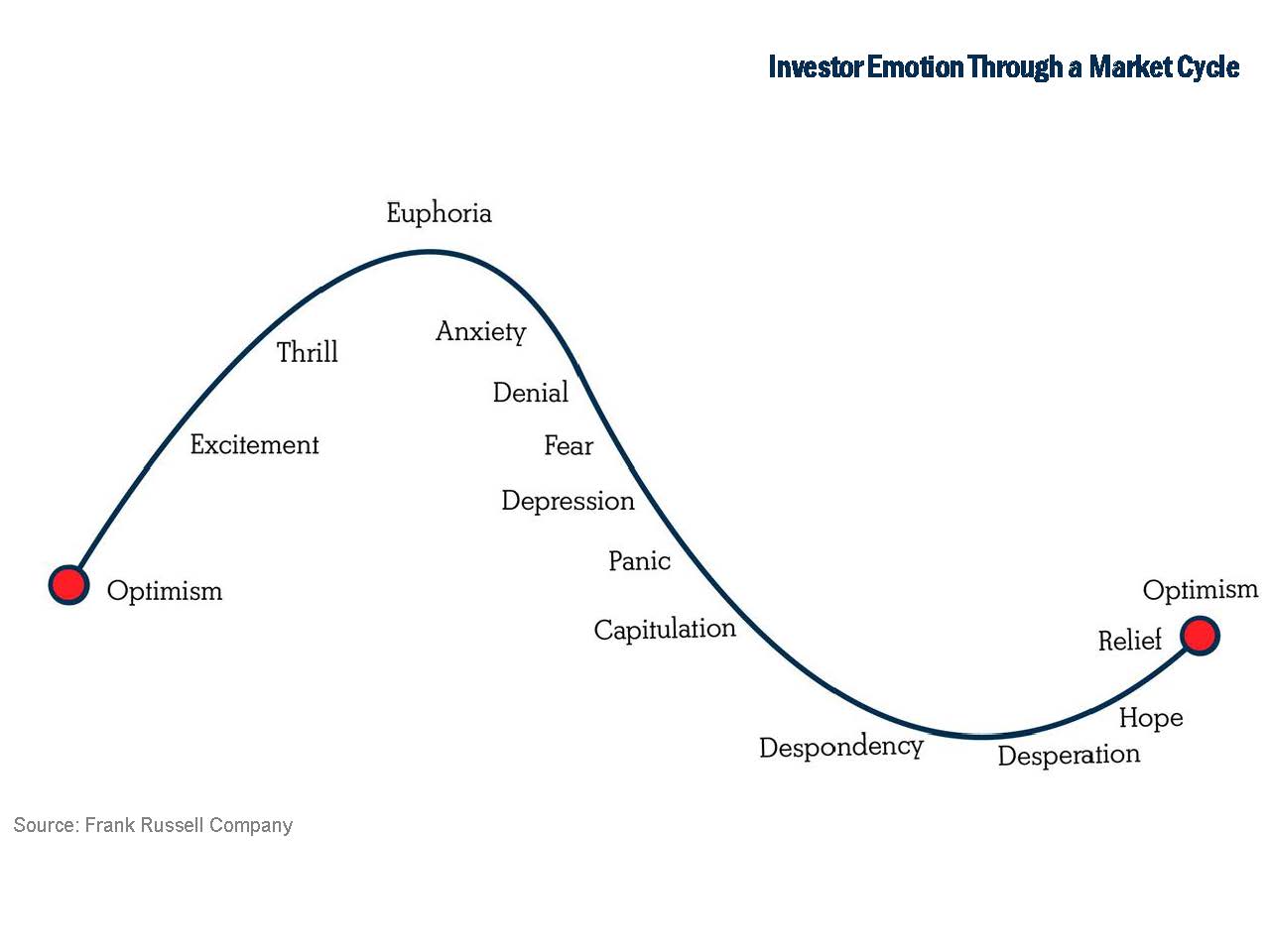

Hold fast to long term investment objectives and align actions accordingly. It is important to understand any dramatic changes to the current investment strategy in the current environment are likely to be costly. Where possible, waiting for more stability may be an option. It is easy to be influenced by market sentiment, which can make decision making particularly difficult given the potential long term consequences.

Liquidity can be poor in turbulent economic conditions like we are currently experiencing as the number of buyers wanting to trade at this time has most certainly reduced. It is also easy to have investment decision influenced by market sentiment, which makes unbiased decision making about long-term goals even more difficult at times like this.

Below is a line chart which shows investor emotion through a market cycle:

2. Diversify investments

Diversification is not a new concept, and should absolutely be considered at the very beginning of an investment strategy consideration. And during times of market volatility, outlines just how important it is. This can be likened to not having all of your eggs in one basket – no matter how confident an investor is on picking the best performing areas, it is invariably better to have a spread of investment exposure across asset classes, suitable for your long-term goals. Providing a little protection, should one investment fall more than others. In the case of a portfolio not being appropriately balanced, we recommend the investor seeks advice, as re-balancing during volatile times can be challenging.

3. Review income generation options

Once the effect of COVID-19 on the share market has subsided and market volatility has subsided, take some time to review your portfolio. It is possible that future income levels expected from the portfolio may have altered due to things such as bond yields changing and future dividends from equities may be reduced (even temporarily).

4. Consider changes to drawdown amounts

Reviewing spending plans for the coming year may show areas where savings will be made, such as an overseas trip which is likely to no longer take place. Investors who are already drawing down from their retirement savings could consider suspending or reducing withdrawals while markets are low. Taking money from a depressed investment can reduce its potential for recover in your portfolio.

5. Maintain investment discipline

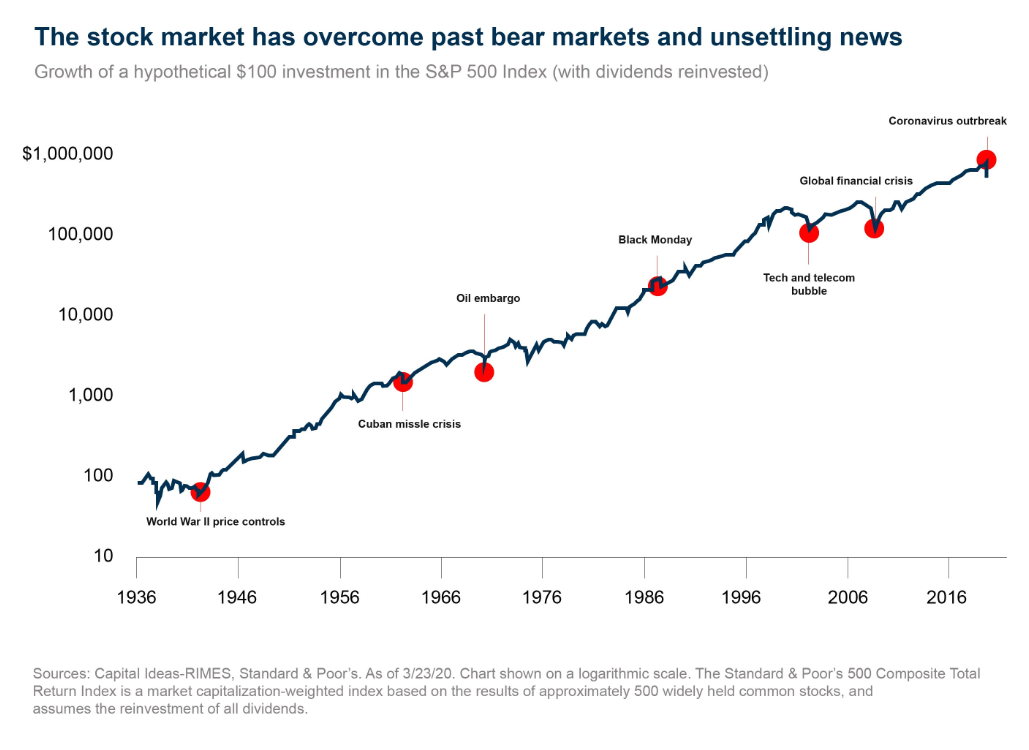

If you are yet to make the change from working to retired and are still building your nest egg, you may choose to keep doing so. Looking at historical market shifts, given time, the market has always recovered and it has the potential to do just that after this crisis. We discuss market insights and the things to consider moving forward here. When markets are down, regular investment contributions may buy more shares or bonds. Changing contributions in response to current volatility may run the risk of missing out on long term growth potential.

THE CURRENT ENVIRONMENT (2023)

Stay Ahead of Inflation: Plan and Protect Your Future in the Post-COVID Environment

In the ever-evolving post-COVID environment, it’s essential to address the new financial landscape and prepare for potential risks such as inflation. The post-COVID environment brings forth a renewed focus on managing and protecting your wealth.

Inflation has become a pressing concern as economies recover and global markets regain stability. By understanding the impact of inflation on your retirement funds and implementing proactive measures, you can effectively plan for the future and preserve the purchasing power of your hard-earned savings.

Let’s explore the intricacies of the current economic landscape and equip you with the knowledge and tools needed to navigate inflation and secure your financial well-being.

I invite you to join me in my next webinar where I will share invaluable insights tailored to your specific needs. We will delve into the nuances of inflation, examining its impact on your retirement funds and exploring effective strategies to counter its erosive effects. By understanding these dynamics and making informed investment decisions, you can take proactive steps to preserve the purchasing power of your hard-earned savings.

I am excited to share my expertise and guide you in planning strategically for a prosperous future. Don’t miss this exclusive opportunity to learn from me, an experienced industry professional. Register now for this free webinar and empower yourself to take control of your financial destiny.

Modoras remain committed to your financial confidence, if you have questions or are not sure what action to take during times of market volatility, please contact a Modoras Planner on 1300 888 803.

IMPORTANT INFORMATION: This blog has been prepared by Modoras Pty. Ltd. ABN 86 068 034 908 an Australian Financial Services and Credit Licences (Number 233209). The information and opinions contained in this presentation is general information only and is not intended to represent specific personal advice (Accounting, taxation, financial, insurance or credit). No individuals’ personal circumstances have been taken into consideration for the preparation of this material. Any individual making any investment or borrowing decisions should make their own assessment taking into account their own particular circumstances. The information and opinions herein do not constitute any recommendation to borrow funds or purchase, sell or hold any particular investment. Modoras Pty Ltd recommends that no financial product or financial service be acquired or disposed of, credit contract entered into or financial strategy adopted without you first obtaining professional personal financial advice suitable and appropriate to your own personal needs, objectives, goals and circumstances. Information, forecasts and opinions contained in this blog may change without notice. Modoras Pty. Ltd. does not guarantee the accuracy of the information at any particular time. Although care has been exercised in compiling the information contained within, Modoras Pty. Ltd. does not warrant that the articles within are free from errors, inaccuracies or omissions. To the extent permissible by law, neither Modoras Pty. Ltd. nor its employees, representatives or agents (including associated and affiliated companies) accept liability for loss or damages incurred as a result of a person acting in reliance of this publication.