News

Peter Thornhill's My Say - No. 69

This one is good news.

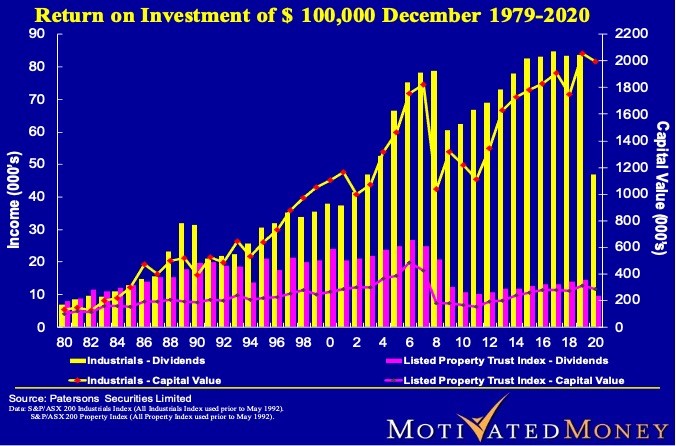

I want to cover a couple of topics here so will curtail my verbosity. Let’s begin with another update, the Listed Property Trust index. I had covered yet again in detail in ‘My Say No 63’ so I merely want to confirm the trend.

The chart below says it all but let me remind you that by ignoring LPT’s as part of your portfolio you can harvest a tidy increase in your performance and income. Keep the lead out of the saddle bag.

I would like you to pay particular attention to the reduction in industrial dividends in 2020 caused by the impact of Covid and I will ask you to return to this chart again soon.

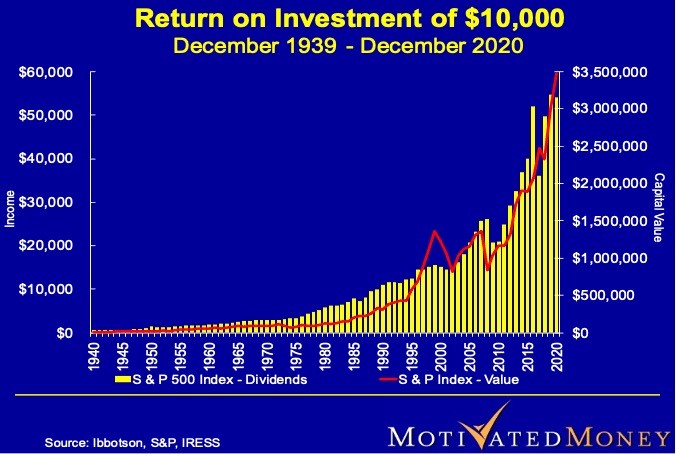

On a happier note, I thought I would allow you to see what a resilient share market looks like. Below is the S&P 500 from the time the second world war broke out to December 2020, noting that the US economy is not reliant on digging stuff out of the ground with materials representing only 2.64% of their index (versus 18.5% in the ASX!).

As some of you may have idle time; consider all the ‘horrifying’ events that have transpired over the last 80 years and take some comfort from the fact that human endeavour does not grind to a halt. Also notice the resilience of the dividend stream.

No doubt we are facing unpleasant times at present, so I was looking for a little bit of good news and, hey presto I got great news instead. I foreshadowed in My Say No 67 (July) my optimism regarding the forthcoming dividend season in a suitably low-key manner and I quote.

“The next dividend season for the second half of this year kicks off in Aug – Sept and I am reasonably confident that we will see an improvement again. Same old, same old!”

How was I to know the magnitude of the event until this article appeared in this morning’s SMH (16th Sept) and brought a smile to my face.

“If you thought dividends have caused a bit of market turbulence in recent weeks, hold on to your hat. According to Commsec, distributions to investors is about to hit its peak. The broker says ASX 200 companies paid about $5.5 billion in dividends to investors between mid-August and September 17, but the distributions will reach a peak starting next week with more than $15 billion cash handed to investors.

CommSec estimates that more than $41 billion in dividends will be paid in coming weeks compared to just $25.8 billion for the interim reporting season in February and $21.6 billion during the 2020 reporting season. In the February 2020 season, the last season untainted by COVID concerns, it was $27.5 billion. “Some analysts are forecasting record annual dividend growth of around 17 per cent, more than triple the average annual growth rate,” Commsec’s chief economist Craig James said.”

I hope you are there to enjoy the shower coming our way. The only dampener to my joy was remembering my newsletter No 67 referencing the huge foreign ownership of Australian companies. Since most Australians are totally dazzled by gambling on unproductive residential property, too much of that $41 billion will slip away overseas.

However, if I may show my age, that will have no effect on the dollars about to coming raining down on our heads. Refer back to my first chart and consider the leap in the yellow bar we are about to experience.

I wish all subscribers good health and wealth for the future.

Happy to help

If you have any questions regarding anything in this newsletter, or just investing in general, then please drop us a line anytime. We are always more than happy to have a chat.

Disclaimer: The views expressed on these articles are those of the authors named, and not those of Modoras Pty Ltd, or any of its employees. Past performance is not an indication or guarantee of future performance. The ideal investment vehicle for an investor is dependent on personal outcomes. It is vital to obtain tailored advice specific to your circumstance before taking action. While we try to ensure that the information we provide is correct, mistakes do occur and we cannot always guarantee the accuracy of the material. All comments posted are the responsibility of the poster. Subsequently, Modoras Pty Ltd does not necessarily agree with or endorse any opinions expressed. However, we do maintain the right not to publish comments or to remove them without notice.

IMPORTANT INFORMATION: This blog has been prepared by Modoras Pty. Ltd. ABN 86 068 034 908 an Australian Financial Services and Credit Licences (Number 233209). The information and opinions contained in this article is general information only and is not intended to represent specific personal advice (Accounting, taxation, financial, insurance or credit). No individuals’ personal circumstances have been taken into consideration for the preparation of this material. Any individual making any investment or borrowing decisions should make their own assessment taking into account their own particular circumstances. The information and opinions herein do not constitute any recommendation to borrow funds or purchase, sell or hold any particular investment. Modoras Pty Ltd recommends that no financial product or financial service be acquired or disposed of, credit contract entered into or financial strategy adopted without you first obtaining professional personal financial advice suitable and appropriate to your own personal needs, objectives, goals and circumstances. Information, forecasts and opinions contained in this blog may change without notice. Modoras Pty. Ltd. does not guarantee the accuracy of the information at any particular time. Although care has been exercised in compiling the information contained within, Modoras Pty. Ltd. does not warrant that the articles within are free from errors, inaccuracies or omissions. To the extent permissible by law, neither Modoras Pty. Ltd. nor its employees, representatives or agents (including associated and affiliated companies) accept liability for loss or damages incurred as a result of a person acting in reliance of this publication.