Insights

How does Global Inflation impact Australian Investors?

Inflation is the rate at which the price of goods and services rise (and the power of money falls). It’s an issue for everyone (no one likes paying more for anything), but while you’re earning income, your salary should (in theory), increase along with the cost of living, leaving you no better or worse off. For retirees, who are now surviving on their savings and investments, inflation can be a threat, because the cost of living increases, while the value of their investments may not. If you have a good financial planner, they have most likely built a buffer for inflation into your retirement targets to counteract these increases.

Australia’s Reserve Bank’s policy on inflation is to keep it low (between 2-3% on average). It’s not alone in its efforts; central banks in countries around the world also fear high inflation, especially a sudden spike. Australia is part of the global economy, and the Reserve Bank is aware of the inflation levels of our trading, investment and tourism partners when making decisions and taking action on our own domestic inflation targets.

Before we go any further, here’s a quick lesson on Monetary Policy.

What’s Monetary Policy?

This is the way a country’s central bank (in Australia’s case the Reserve Bank or RBA) will control the supply of money, attempting to keep stability and strength in the currency and the overall cost of living.

One of the most common ways it does this, is by raising or lowering the cost of money (interest rates). Low interest rates stimulate economic growth. Businesses are encouraged to borrow money to expand, investors might choose shares or property investment over a savings account that pays little interest1. Property prices could rise and share prices too. Slow, steady growth is great and exactly what the RBA wants.

In the early 1990s the RBA made a commitment to maintain low and stable inflation (between 2-3% averaged over time). A statement by Ian McFarlane, the RBA governor in 2005, said the RBA had chosen this policy because low inflation is needed for sustainable economic growth2. And it’s worked. Since this decision was made, inflation has been fairly stable, with a spike over 4% in 2008/2009 being its wildest moment.

Is the RBA in control of inflation, or are there other influences?

So, is all this stability and control over inflation due to Australia’s monetary policy and the skills of the Reserve Bank? Or have overseas economies also had an influence?

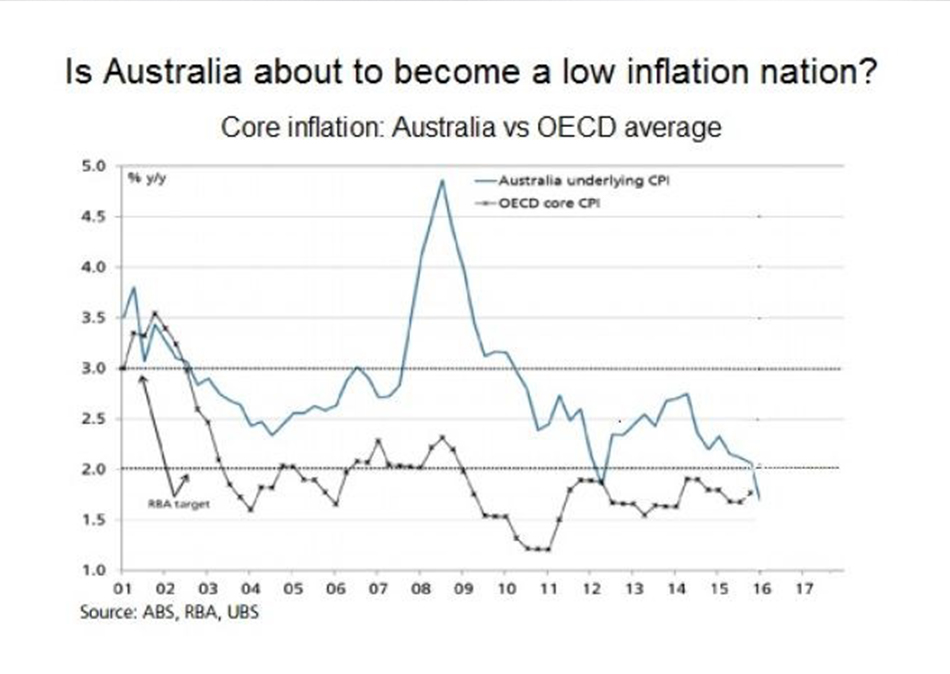

Well, while the RBA can definitely take some credit for being completely focused on keeping inflation fairly low for 16 years, there’s no doubt that Australian inflation has roughly followed the Organisation for Economic Cooperation and Development (OECD) since 2001. This is shown by the graph below.

So, Australian inflation is definitely influenced by overseas forces and inflation (global or local) impacts on Australian investors. Australia is influenced by global inflation because of the relationships we share with overseas economies, as trading partners, economic partners, trade agreement partners, geographical neighbours and many other reasons.

When the Reserve Bank acts to curb growing inflation or to stimulate economic growth it changes interest rates. This kicks on to impact the cost of borrowing, the amount of interest earnable on cash balances and the general cost of living faced by every Australian (investor or otherwise).

Here’s how inflation will most likely impact your investments:

Share prices

Share prices don’t always move predictably when inflation rises and falls. It’s partially related to the industry of the company you have shares in and also how fast and in which direction inflation is moving. Investopedia cites a study that says share prices have the best returns when inflation is around 2-3%. Higher or lower seems to signal other issues with the economy and the market in general that could have a more powerful influence on share prices than inflation does. This means share prices become harder to predict4.

Property investment

As for interest rates, it’s a chicken and egg situation. Low interest rates mean people can borrow more money, this means they have more to spend which causes the economy to grow and inflation increase, if inflation increases too much (especially too fast) the central bank will usually increase interest rates so people borrow less and spend less and inflation goes down again. For Australians with investments in property, low interest rates are ideal. If investments are mostly held in cash or term deposits, then it’s not so great.

General Cost of living

This is a big fear for retirees, as mentioned above. Making sure you have enough retirement savings to cover your proposed lifestyle plus inflation adds an extra burden on anyone saving for retirement, and an extra layer of stress on those already retired.

Here’s why: Say you have $1m in retirement savings and you’re earning 7% on the balance (a respectable $70k). You can, theoretically, live off the interest indefinitely. But if you’re needing enough money to cover the rising cost of living, you’ll need to take out more. A 3% inflation rate reduces earnings of 7% to just 4%. Slowly but surely your savings will begin to erode5.

For now, local inflation is staying under 3%. Global inflation (in most of the countries that significantly influence the Australian economy) is about the same. Australian investors have little to worry about for the foreseeable future. If inflation suddenly started rising, in Australia or overseas, there could be knock on effects for Australian investors and retirees as prices increase quickly with no corresponding increase in income for anyone.

Like many things in life, inflation is good in moderation

A fast rising cost of living makes life hard, especially when salaries don’t always increase at the same rate. There’s no doubt that global inflation affects Australian investments in cash, shares and property, but it’s hard to predict. Inflation (Australian or otherwise) is a big advertisement for diversification because then at least you’re more likely to weather the rises and falls of your various assets.

If you’d like some advice on how inflation affects your investments, contact our expert advisers at Modoras on 1300 888 803.

Some more articles that may interest you:

Sources:

1. Investopedia: Monetary Policy

2. RBA: Publications, June 2005 – Ian MacFarlane: Global Influences on the Australian Economy

3. ABC News: April 2016 – Australia joining low inflation world

4. Investopedia: Inflation’s impact on stock returns

5. Superguide: Boost your Superannuation – Retirement: why can’t $1m last forever

IMPORTANT INFORMATION: This blog has been prepared by Modoras Pty. Ltd. ABN 86 068 034 908 an Australian Financial Services and Credit Licences (No. 233209), located at Level 3, 50-56 Sanders St, Upper Mt Gravatt Q 4122. The information and opinions contained in this fact sheet are general information only and is not intended to represent specific personal advice (Accounting, taxation, financial, insurance or credit). No individuals personal circumstances have been taken into consideration for the preparation of this material. Any individual making a decision to buy, sell or hold any particular financial product should make their own assessment taking into account their own particular circumstances. The information and opinions herein do not constitute any recommendation to purchase, sell or hold any particular financial product. Modoras Pty. Ltd. recommends that no financial product or financial service be acquired or disposed of or financial strategy adopted without you first obtaining professional personal financial advice suitable and appropriate to your own personal needs, objectives, goals and circumstances. Information, forecasts and opinions contained in this fact sheet can change without notice. Modoras Pty. Ltd. does not guarantee the accuracy of the information at any particular time. Although care has been exercised in compiling the information contained within, Modoras Pty. Ltd. does not warrant that the articles within are free from errors, inaccuracies or omissions. To the extent permissible by law, neither Modoras Pty. Ltd. nor its employees, representatives or agents (including associated and affiliated companies) accept liability for loss or damages incurred as a result of a person acting in reliance of this publication.