Insights

Economic Update - June 2022

News of share market declines is spreading far and wide as rising interest rates and inflation both in Australia and Internationally, are noted as contributing to the ‘sell-off’. These events typically get a lot of media and leave many investors understandably wondering – what does this mean for my portfolio?

Recent volatility is no different to what we have seen historically. Although the trigger that causes the market movements may be slightly different. We provide a summary below of the current market conditions. It is important to consider that the results of the share market do not always mirror the performance of an investment portfolio. And that the information provided is of a general nature, focused on share market indicators as opposed to the performance of any investment portfolio.

Market Movements and Performance

In early June, the interest rate rise triggered a large sell off. The S&P 500 (-5%), NASDAQ (-5.6%), Euro STOXX 50 (-4.9%), ASX200 (-4.3%). This extended what has appeared to be a ‘sell-off’ trend this year, as year-to-date share market performances trend slightly down. S&P 500 (-17.6%), NASDAQ (-27.3%) Euro STOXX 50 (-18.5%), ASX (-5.5%).

Asset class returns to the end of May are shown in the table below:

| Trailing Returns | Period ended 31 May 2022 | |||||

|---|---|---|---|---|---|---|

| Change, Total Return Basis | 1 mth | 3 mths | 12 mnths | 3 yrs (p.a.) | 5 yrs (p.a.) | 10 yrs (p.a.) |

| Australian Shares | -2.8 | 3.1 | 4.7 | 8.0 | 9.0 | 10.3 |

| Australian Small Caps | -7.0 | -3.6 | -4.6 | 5.5 | 8.5 | 6.3 |

| Global Shares – All Country (Local) | -0.2 | -4.4 | -3.2 | 12.2 | 9.5 | 11.4 |

| Global Shares – All Country (Unhedged) | -0.8 | -4.8 | 0.6 | 10.4 | 9.8 | 13.6 |

| US Shares (USD) | 0.2 | -5.2 | -0.3 | 16.4 | 13.4 | 14.4 |

| Europe Shares (EUR) | 0.9 | -1.7 | -3.8 | 7.2 | 3.7 | 8.8 |

| Emerging Mkts Shares (Local) | -0.2 | -5.7 | -15.7 | 6.5 | 5.7 | 6.7 |

| Global Property (Hedged) | -4.6 | -4.1 | -1.2 | 1.7 | 3.7 | 8.0 |

| Australian Property | -8.7 | -7.1 | 3.3 | 2.2 | 5.7 | 10.8 |

| Global Infrastructure (Hedged) | 1.8 | 6.4 | 10.7 | 6.6 | 6.8 | 10.8 |

| Australian Fixed Interest Composite | -0.9 | -6.0 | -8.5 | -1.8 | 1.0 | 2.7 |

| Global Fixed Interest Composite (Hedged) | -0.2 | -5.1 | -7.4 | -0.7 | 1.1 | 3.3 |

| Cash – Bank Bills | 0.0 | 0.0 | 0.0 | 0.4 | 1.0 | 1.8 |

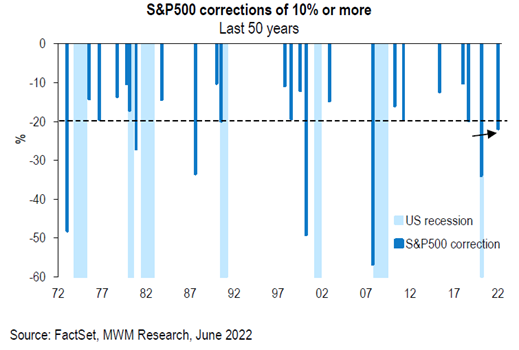

Providing context to this correction relative to history, the below table shows that the US market is now officially a “bear market” meaning it currently sits 20% lower than its all-time highs. As you can see the current market correction is already larger than the average correction, meaning the major falls are possibly behind us. However, there have been corrections of a greater magnitude than the current one. Historically the extreme corrections previously seen are periods that have been associated with recessionary environments.

What is causing the sell-off?

- Higher-than-expected US inflation data released last Friday has helped push equity markets down. Financial markets have reacted to the increasing fears that high interest rates will lead the economy into recession.

- The US Fed meets tonight (Wednesday night), and the market is pricing an 80% chance of a 75bp hike. The rationale is they need to “get in front of the curve” and restore confidence that inflation will be subdued. There is a growing view the Fed has to choose between allowing inflation to stay high or triggering a recession.

- This theme is probably particularly relevant to Australia given our relatively high house prices, debt levels and size of the Australian banks in the index.

What do the experts think of this?

The quote below from Blackrock is a great summary of our view:

“We see central banks ultimately opting to live with inflation instead of raising policy rates to a level that destroys growth. That means inflation will likely stay higher than pre-Covid levels. We also think the Fed will quickly raise rates and then hold off to see the impact. The question is when this dovish pivot will take place. We think the sum total of rate hikes will be historically low”.

Stay focused on the long-term objectives

Nothing in these market conditions causes any need to re-think the foundation of an investment strategy that is built on solid rigour. Share markets often move up and down, influenced by human behaviour. Over the long term, it can be expected that the share market will return to some form of stability and short-term market prices are determined by the reactions of many, to short-term problems such as rising interest rates, wars, pandemics etc. In the long run, asset prices are determined by the quality of the asset and its ability to produce returns and income for its owners. After all, markets don’t go up in straight lines!

Ultimately, share markets will continue their ebbs and flows as they always have, and recent movements are no different. We recommend investors look at the current state of play as an opportunity. As short-term volatility may create opportunities for long-term gain.

For more information on market volatility, you may refer to our fact sheet below and if you have any questions or are not sure what action to take during times of market volatility, please contact a Modoras Planner on 1300 888 803.

Call us – we’re happy to help!

Unsure about what impact, if any, this will have on your financial situation? If so, please feel free to contact us to arrange a coffee and a chat with a Modoras professional. Book a meeting today or give us a ring on 1300 888 803!

Financial Planning and Credit services are offered through Modoras Pty Ltd ABN 86 068 034 908. Australian Financial Services and Credit Licence No. 233209.

Accounting and business services are offered through Modoras Accounting (QLD) Pty Ltd ABN 81 601 145 215. Liability limited by a scheme approved under the Professional Standards Legislation.

FinancialLine UMG Pty Ltd ABN 24 741 319 847 is a corporate authorised representative (No. 280169) of Modoras Pty Ltd.

Modoras Wealth Management (QLD) Pty Ltd ABN 66 623 115 668 is a corporate authorised representative (No. 1268659) of Modoras Pty Ltd.

IMPORTANT INFORMATION: This email has been prepared by Modoras Pty. Ltd. ABN 86 068 034 908 an Australian Financial Services and Credit Licences (Number 233209). The information and opinions contained in this presentation is general information only and is not intended to represent specific personal advice (Accounting, taxation, financial, insurance or credit). No individuals’ personal circumstances have been taken into consideration for the preparation of this material. Any individual making any investment or borrowing decisions should make their own assessment taking into account their own particular circumstances. The information and opinions herein do not constitute any recommendation to borrow funds or purchase, sell or hold any particular investment. Modoras Pty Ltd recommends that no financial product or financial service be acquired or disposed of, credit contract entered into or financial strategy adopted without you first obtaining professional personal financial advice suitable and appropriate to your own personal needs, objectives, goals and circumstances. Information, forecasts and opinions contained in this blog may change without notice. Modoras Pty. Ltd. does not guarantee the accuracy of the information at any particular time. Although care has been exercised in compiling the information contained within, Modoras Pty. Ltd. does not warrant that the articles within are free from errors, inaccuracies or omissions. To the extent permissible by law, neither Modoras Pty. Ltd. nor its employees, representatives or agents (including associated and affiliated companies) accept liability for loss or damages incurred as a result of a person acting in reliance of this publication.